All Categories

Featured

Table of Contents

- – Most Affordable Accredited Investor Alternativ...

- – High-Value Passive Income For Accredited Inves...

- – High-Quality Accredited Investor Syndication ...

- – Private Equity For Accredited Investors

- – Reliable Accredited Investor Crowdfunding Op...

- – Expert Accredited Investor Investment Networ...

- – Expert Accredited Investor Alternative Asset...

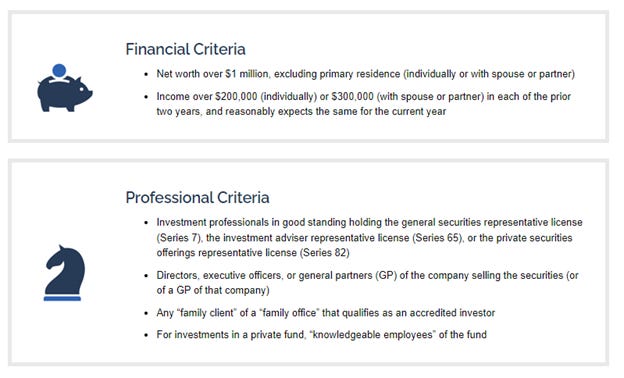

The guidelines for accredited capitalists vary amongst territories. In the U.S, the interpretation of a recognized financier is put forth by the SEC in Policy 501 of Law D. To be a recognized capitalist, a person has to have an annual revenue exceeding $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of making the very same or a higher earnings in the current year.

A recognized capitalist should have a total assets exceeding $1 million, either separately or jointly with a spouse. This amount can not consist of a main home. The SEC additionally considers applicants to be accredited capitalists if they are general companions, executive policemans, or directors of a company that is providing unregistered safety and securities.

Most Affordable Accredited Investor Alternative Asset Investments

Additionally, if an entity includes equity owners who are approved financiers, the entity itself is a certified capitalist. A company can not be developed with the sole objective of acquiring specific safety and securities. A person can certify as a recognized investor by showing adequate education and learning or job experience in the economic sector

People that intend to be certified financiers do not put on the SEC for the classification. Rather, it is the duty of the business providing a private positioning to ensure that every one of those approached are recognized investors. People or parties who intend to be certified capitalists can come close to the company of the non listed securities.

Expect there is a private whose earnings was $150,000 for the last 3 years. They reported a main house worth of $1 million (with a home mortgage of $200,000), an auto worth $100,000 (with a superior finance of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Internet worth is determined as assets minus liabilities. This person's net well worth is specifically $1 million. This entails a computation of their possessions (besides their key home) of $1,050,000 ($100,000 + $500,000 + $450,000) much less an auto loan equaling $50,000. Since they satisfy the total assets need, they qualify to be an accredited capitalist.

High-Value Passive Income For Accredited Investors

There are a couple of less usual certifications, such as handling a depend on with even more than $5 million in assets. Under government safeties legislations, just those who are approved financiers may participate in specific safety and securities offerings. These may consist of shares in private positionings, structured items, and exclusive equity or bush funds, among others.

The regulatory authorities desire to be certain that individuals in these highly dangerous and complicated financial investments can fend for themselves and evaluate the risks in the absence of government defense. The certified capitalist regulations are developed to safeguard potential investors with restricted monetary knowledge from high-risk ventures and losses they may be unwell geared up to endure.

Certified financiers satisfy qualifications and expert requirements to access exclusive financial investment possibilities. Designated by the United State Stocks and Exchange Compensation (SEC), they gain entrance to high-return alternatives such as hedge funds, endeavor resources, and private equity. These financial investments bypass full SEC enrollment but lug greater risks. Approved investors need to fulfill earnings and total assets needs, unlike non-accredited individuals, and can spend without constraints.

High-Quality Accredited Investor Syndication Deals for Accredited Investors

Some vital changes made in 2020 by the SEC consist of:. Consisting of the Series 7 Series 65, and Series 82 licenses or various other credentials that reveal economic expertise. This modification acknowledges that these entity types are frequently made use of for making investments. This adjustment acknowledges the proficiency that these staff members establish.

This modification accounts for the impacts of rising cost of living in time. These changes broaden the accredited capitalist pool by about 64 million Americans. This broader gain access to offers extra chances for investors, however also raises possible dangers as much less monetarily sophisticated, capitalists can get involved. Companies using private offerings may take advantage of a larger pool of possible investors.

These investment options are special to certified financiers and institutions that qualify as an approved, per SEC guidelines. This provides accredited capitalists the opportunity to spend in arising business at a phase before they think about going public.

Private Equity For Accredited Investors

They are seen as investments and come just, to qualified clients. Along with recognized business, certified investors can pick to invest in startups and promising endeavors. This provides them income tax return and the chance to go into at an earlier phase and potentially gain incentives if the business thrives.

However, for investors open up to the threats entailed, backing startups can result in gains. Much of today's tech companies such as Facebook, Uber and Airbnb stemmed as early-stage startups sustained by approved angel capitalists. Sophisticated investors have the chance to explore investment alternatives that might yield extra profits than what public markets provide

Reliable Accredited Investor Crowdfunding Opportunities

Returns are not guaranteed, diversification and portfolio enhancement alternatives are broadened for investors. By expanding their portfolios via these expanded investment opportunities approved investors can enhance their strategies and potentially achieve superior lasting returns with correct danger administration. Skilled capitalists typically run into financial investment options that may not be conveniently offered to the general financier.

Investment options and protections offered to accredited investors typically include greater risks. Exclusive equity, endeavor funding and hedge funds typically concentrate on spending in assets that lug danger but can be liquidated conveniently for the opportunity of greater returns on those high-risk financial investments. Researching before investing is crucial these in situations.

Lock up periods stop financiers from withdrawing funds for more months and years on end. Investors might battle to accurately value exclusive assets.

Expert Accredited Investor Investment Networks with Accredited Investor Support

This adjustment might expand accredited financier standing to a variety of people. Permitting partners in dedicated partnerships to integrate their sources for shared eligibility as certified investors.

Making it possible for individuals with certain expert accreditations, such as Series 7 or CFA, to certify as recognized capitalists. Creating extra demands such as proof of monetary proficiency or successfully finishing a recognized capitalist examination.

On the other hand, it could additionally result in knowledgeable investors thinking too much dangers that may not appropriate for them. Safeguards may be required. Existing certified financiers may encounter enhanced competitors for the finest financial investment chances if the pool expands. Business raising funds might gain from an expanded recognized investor base to attract from.

Expert Accredited Investor Alternative Asset Investments

Those that are presently thought about recognized investors need to remain upgraded on any alterations to the standards and laws. Their eligibility could be based on adjustments in the future. To keep their status as accredited financiers under a revised interpretation adjustments may be required in wide range monitoring strategies. Businesses seeking accredited investors should remain watchful concerning these updates to ensure they are attracting the ideal target market of financiers.

Table of Contents

- – Most Affordable Accredited Investor Alternativ...

- – High-Value Passive Income For Accredited Inves...

- – High-Quality Accredited Investor Syndication ...

- – Private Equity For Accredited Investors

- – Reliable Accredited Investor Crowdfunding Op...

- – Expert Accredited Investor Investment Networ...

- – Expert Accredited Investor Alternative Asset...

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing

More

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing