All Categories

Featured

Table of Contents

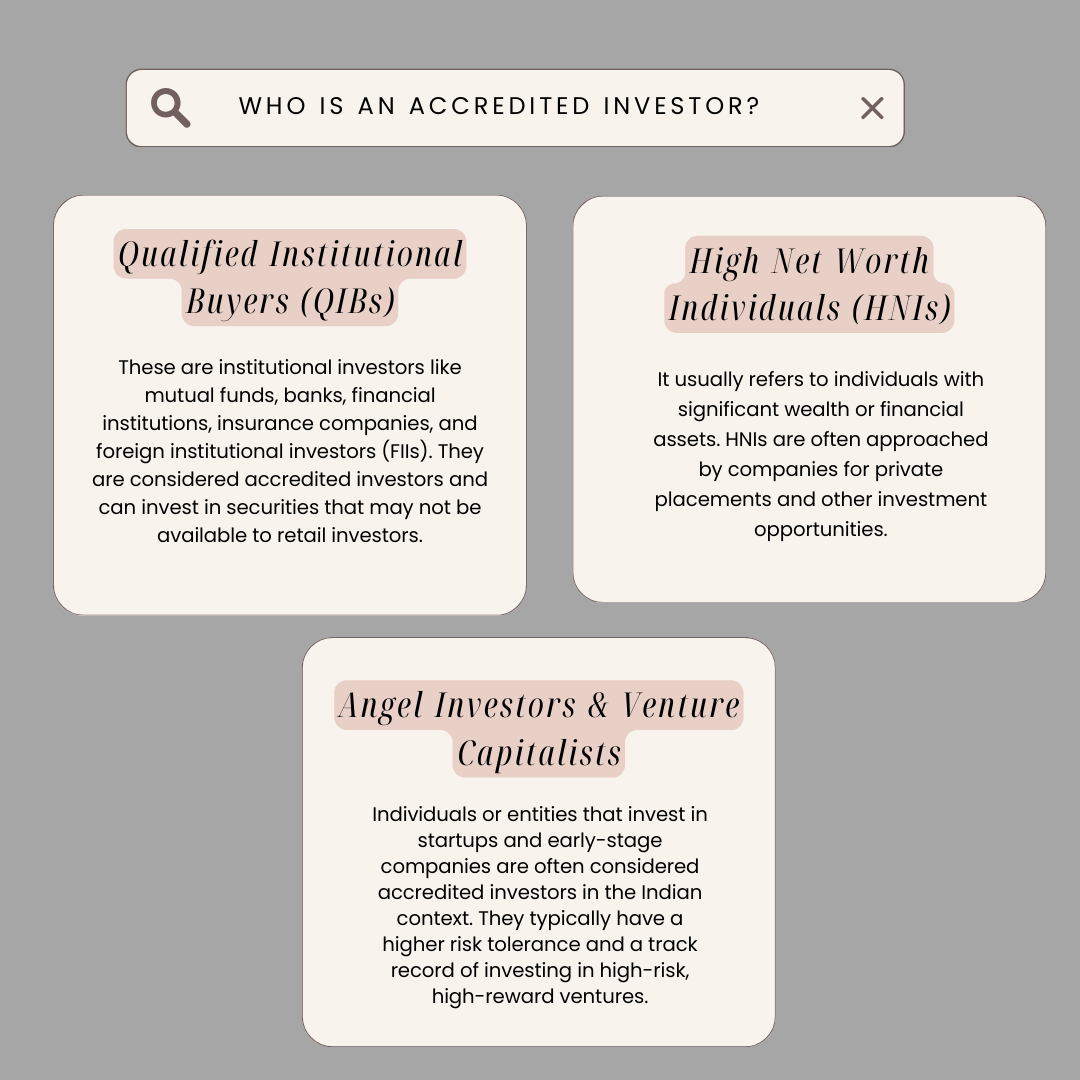

If you're an investment expert with a Collection 7, Series 65 or Series 82 or ready to become one sometimes you're considered an accredited financier. Very same if you go to the supervisor or above degree of the firm marketing the security, or if you're a knowledgeable worker of a private fund that you want to buy.

There are a wide selection of possibilities for accredited capitalists. The on-line investing system Yield Street, for instance, provides art, crypto, actual estate, venture funding, short-term notes, legal finance funds and various other specific asset classes. Other platforms, AcreTrader and Percent, for circumstances, offer accessibility to farmland investments, seller cash loan and more.

Generally talking, these sorts of possibilities aren't provided they come from that you recognize and what you're associated with. private placements for accredited investors. For some, this could imply very early rounds of startup investing, bush funds or various other sorts of exclusive funds. Your financial investment consultant might likewise offer you specific monetary instruments or investments to take into consideration if you're a recognized capitalist.

Bear in mind, the intent behind avoiding retail investors from buying non listed protections is to secure those who do not have the economic means to endure big losses.

Superior Accredited Investor Crowdfunding Opportunities

A private should have an internet worth over $1 million, excluding the main residence (independently or with spouse or partner), to certify as an approved capitalist - private placements for accredited investors. Showing sufficient education and learning or task experience, being a registered broker or financial investment expert, or having certain expert qualifications can additionally qualify an individual as an accredited investor

Certified investors have access to financial investments not signed up with the SEC and can include a "spousal matching" when identifying qualification. Approved capitalists might deal with potential losses from riskier investments and should show economic refinement to join uncontrolled investments. Certified capitalist status matters because it determines qualification for financial investment chances not offered to the basic public, such as personal positionings, venture resources, hedge funds, and angel financial investments.

To take part, approved investors need to approach the issuer of unregistered securities, that might require them to complete a set of questions and offer economic records, such as income tax return, W-2 kinds, and account statements, to confirm their standing. Laws for recognized capitalists are supervised by the U.S. Stocks and Exchange Commission (SEC), making sure that they meet details economic and expert requirements.

Private Equity For Accredited Investors

This development of the recognized financier pool is intended to keep financier defense while providing greater access to unregistered investments for those with the necessary monetary elegance and risk tolerance.

The modern-day period has opened the door to so many recognized financier opportunities that it can make you lightheaded. It's one thing to generate income; it's quite one more holding onto it and, undoubtedly, doing what's required to make it expand. The field has many verticals covering traditional asset classes like equities, bonds, REITs and common funds.

The trouble? While these recognized capitalist financial investment chances are amazing, it can be difficult to know where to begin. If you need to know the most effective financial investments for recognized capitalists, you remain in the best area. Maintain checking out for a list of the 10 finest platforms and chances for accredited capitalists.

Leading Real Estate Investments For Accredited Investors

First, let's make certain we're on the exact same page about what a certified capitalist is. You can certify as a recognized financier in a couple of ways: A) You have the ideal licensure a Series 7, Series 65, or Series 82 FINRA certificate. B) You fulfill the monetary standards.

Have a look at the Whether you're an accredited investor currently or simply intend to be educated for when you are, here are the very best certified financier investments to think about: Score: 8/10 Minimum to start: $10,000 Equitybee offers recognized financiers the chance to buy firms before they go public. This indicates you don't have to await a firm to IPO to come to be a stakeholder.

There are lots of big-name (yet still not public) companies currently readily available on Equitybee: Impressive Gamings, Stripes, and Waymo, among others. Once you have actually selected a firm, you can fund a worker's stock choices through the system. Easily, you're a stakeholder. private equity for accredited investors. Now, when a successful liquidity event happens, you're entitled to a portion of the profits.

Nevertheless, the ability to get to pre-IPO business may deserve it for some capitalists. Score: 8/10 Minimum to get going: Arrays; usually $10,000 Yieldstreet is a great area to diversify commonly from a solitary system. The "one-stop-shop" element alone might make it one of the top recognized capitalists' investments, yet there's much more to such as concerning the system.

Most Affordable Exclusive Deals For Accredited Investors

(Source: Yieldstreet) Rating: 8/10 Minimum to get begun: No less than $10,000; most opportunities vary in between $15K and $40K Well-off capitalists frequently turn to farmland to expand and develop their portfolios. Why? Well, consider this: Between 1992-2020, farmland returned 11% annually, and only experienced 6.9% volatility of return. Plus, it has a reduced correlation to the securities market than a lot of different possessions.

However you can still profit from farmland's land recognition and possible rental earnings by purchasing a system like AcreTrader. (Source: AcreTrader) AcreTrader is just readily available to recognized capitalists. The platform offers fractional farmland investing, so you can spend at a lower price than buying the land outright. Right here's what's fantastic concerning the platform: AcreTrader does the heavy lifting for you.

Leading Investment Platforms For Accredited Investors

In terms of exactly how you obtain paid, AcreTrader pays out annual income to investors. According to their website, this has traditionally yielded 3-5% for lower-risk financial investments. Once you've offered proof of certification and set up your account, you'll obtain access to the Industry, which features both equity and debt investment opportunities which could be multifamily buildings or retail, office, or also land chances.

On Percent, you can likewise buy the Percent Blended Note, or a fund of various credit scores offerings. It's a very easy method to branch out, yet it does have higher minimums than several of the other opportunities on the platform. By the method, the minimum for the majority of possibilities on Percent is fairly tiny for this checklist just $500.

Accredited Investor Funding Opportunities

You can both spend in the main market and profession on the second market with other art capitalists. If it sells for an earnings, the proceeds are distributed amongst capitalists.

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing