All Categories

Featured

Table of Contents

- – Custom Property Tax Overages Program Best Stat...

- – High-Quality Real Estate Overage Funds Trainin...

- – Reputable Bob Diamond Overages Training Tax O...

- – Expert Bob Diamond Overages Guide Tax Foreclo...

- – Efficient Mortgage Foreclosure Overages Lear...

- – Unmatched Property Tax Overages Strategy Mor...

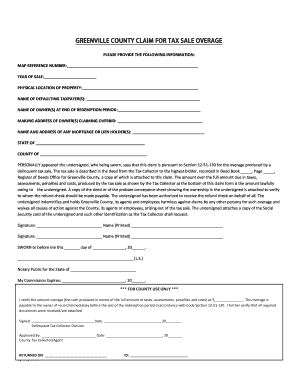

Examine its precision with a third-party expert prior to you obtain started). (ideally, a few months from the foreclosure date, when motivated vendors are to dump their residential or commercial property for next-to-nothing prices).

Play the waiting game until the building has actually been seized by the region and marketed and the tax obligation sale.

Custom Property Tax Overages Program Best States For Tax Overages

Going after excess profits uses some pros and disadvantages as an organization. There can be some HUGE upside prospective if and when the celebrities line up in your favorthey seriously need to in order to accomplish the finest feasible result.

There is the opportunity that you will certainly make absolutely nothing in the end. You might shed not just your money (which ideally won't be quite), yet you'll also shed your time also (which, in my mind, is worth a whole lot much more). Waiting to accumulate on tax obligation sale overages requires a lot of sitting, waiting, and expecting outcomes that generally have a 50/50 chance (typically) of panning out positively.

Accumulating excess earnings isn't something you can do in all 50 states. If you've already obtained a residential or commercial property that you intend to "roll the dice" on with this approach, you 'd much better hope it's not in the incorrect part of the nation. I'll be honestI haven't invested a great deal of time meddling this area of spending because I can not take care of the mind-numbingly slow-moving speed and the total absence of control over the procedure.

If this seems like a business opportunity you wish to study (or at least discover more concerning), I recognize of one person who has developed a full-on training course around this details kind of system. His name is and he has explored this world in terrific detail. I have actually been with a number of his programs in the past and have located his methods to be extremely efficient and reputable lucrative techniques that work incredibly well.

High-Quality Real Estate Overage Funds Training Foreclosure Overages

The sale will certainly begin at 9:00 am, Monday, November 4, 2024, and will return to on complying with days at 9:00 am, if required. There will certainly be no lunch breaks. TAX SALE LISTING: Starting on Monday, September 9, 2024, a listing of properties will certainly be offered on the Charleston Region internet site () and in the Overdue Tax Obligation Workplace.

Final listings will certainly be offered to signed up bidders on the day of the sale. BIDDER REGISTRATION: Registration will start Monday, September 9, 2024, and end Friday, October 25, 2024 @ 5pm. There will be no enrollment on the day of the tax obligation sale. Registration is readily available online this year. You may likewise register in the office with cash money, check, or credit score card.

Reputable Bob Diamond Overages Training Tax Overage Recovery Strategies

Registration cost has actually increased to $15. TAX OBLIGATION SALE PROCEDURES: Residence will certainly be auctioned in alphabetical order, by proprietor surname. The actual estate tax obligation sale will happen initially, adhered to by the mobile home tax obligation sale. All quotes have to be paid by cash order, certified check, or bank cord. There is a $35 charge for all bank cables.

If the sale expands previous or near to completion of company, proposals will schedule the following day by noontime. If proposals are not received already, a $500 default cost, per quote, will certainly be charged and the quote will be positioned with the Forfeited Land Commission. ALL QUOTES ARE FINAL.

Defaulted costs will undergo reasonings if not paid. Proposals will certainly start at the total amount of taxes due at the time of sale. This consists of, taxes, evaluations, penalties, expenses and existing (TY 2024) taxes. The quantity shown on tax sale listings prior to the sale only consist of delinquent tax obligations.

Mobile homes marketed throughout the mobile home tax sale are marketed on their very own and do not consist of the land where they lie. BUNDLED FEATURES: If a specific or company possesses greater than one building that increases for sale, then those residential or commercial properties will certainly be grouped with each other for the objective of the tax sale only.

Expert Bob Diamond Overages Guide Tax Foreclosure Overages

As a prospective buyer, the only home topic to transportation will certainly be the building in which the quote was placed. ONLY ONE PROPERTY WILL BE CONSIDERED SOLD.

This will certainly be a quiet auction where quotes will be positioned using a form provided by our workplace and submitted in a sealed envelope. Historically, all residential properties get bids either with the initial auction or the sealed- bid sale. We currently do not have any kind of remaining buildings. LIENS: Throughout the redemption period, the Delinquent Tax obligation Workplace will notify any type of home mortgage owners connected with the building.

Efficient Mortgage Foreclosure Overages Learning Tax Overages List

Various other kinds of liens (auto mechanic's, IRS, State, and so on) will stay on the residential or commercial property. REDEMPTION: Taxpayers will certainly have one year to retrieve their property from the tax sale. If redeemed, the proprietor will pay tax obligations plus rate of interest to keep their property from being conveyed. Rate of interest is due on the whole quantity of the bid based on the month throughout the redemption duration.

However, the amount of interest due have to not go beyond the quantity of the opening bid on the residential property submitted for the Forfeited Land Payment. Please describe the "Sample Passion Calculation" sheet for more details. Bidders might not retrieve home in which they have actually positioned a bid. Just the skipping taxpayer, beneficiary from the owner, or mortgage or reasoning creditor may redeem a residential property from tax sale.

Unmatched Property Tax Overages Strategy Mortgage Foreclosure Overages

Lease is determined at 1/12th of the TY 2023 original tax quantity without prices, fees, and penalties, but can not be much less than $10 a month. Charleston Area has concerning an 80% redemption price. GAP: The Delinquent Tax Collection agency may require to overturn a tax obligation sale on a property due to lots of factors (personal bankruptcy, area mistake, and so on).

If a tax obligation sale is reversed, bidders will accumulate real rate of interest gained. REIMBURSEMENTS: If a residential or commercial property is retrieved or nullified, the Overdue Tax obligation Workplace will alert prospective buyers by mail.

These invoices are normally on blue paper and have the area seal on the back. If you did not obtain, or are missing your original receipt, please contact our workplace. Prospective buyers need to enable a minimum of twenty (20) company days for the handling of reimbursement checks. The office will not begin the reimbursement procedure up until the original invoice is returned.

If you’re looking for a low-cost way to start a business, recovering surplus funds from property auctions is a profitable opportunity. The expert guidance in Bob Diamond’s tax sales overages list blueprint guides you in finding untapped overages, connect with eligible recipients, and navigate the claims process. This approach is budget-friendly and is scalable, making it an perfect fit for beginners and experienced professionals alike. With Bob’s proven experienceTable of Contents

- – Custom Property Tax Overages Program Best Stat...

- – High-Quality Real Estate Overage Funds Trainin...

- – Reputable Bob Diamond Overages Training Tax O...

- – Expert Bob Diamond Overages Guide Tax Foreclo...

- – Efficient Mortgage Foreclosure Overages Lear...

- – Unmatched Property Tax Overages Strategy Mor...

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing

More

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing