All Categories

Featured

Table of Contents

- – Turnkey Accredited Investor Financial Growth O...

- – Comprehensive Accredited Investor Platforms

- – Value Accredited Investor Property Investment...

- – High-Growth Exclusive Investment Platforms Fo...

- – Tailored Accredited Investor Funding Opportu...

- – Top-Rated Accredited Investor Real Estate In...

- – Best Accredited Investor Passive Income Prog...

The policies for accredited investors vary amongst territories. In the U.S, the meaning of an accredited investor is put forth by the SEC in Regulation 501 of Guideline D. To be an accredited financier, a person should have an annual revenue surpassing $200,000 ($300,000 for joint earnings) for the last 2 years with the expectation of earning the very same or a higher income in the current year.

This quantity can not include a key house., executive policemans, or directors of a business that is issuing non listed safeties.

Turnkey Accredited Investor Financial Growth Opportunities

If an entity consists of equity proprietors who are accredited capitalists, the entity itself is a recognized investor. Nevertheless, an organization can not be formed with the single objective of acquiring details securities - accredited investor platforms. A person can certify as a recognized capitalist by demonstrating sufficient education and learning or task experience in the monetary market

Individuals who intend to be recognized capitalists don't put on the SEC for the designation. Rather, it is the duty of the firm providing an exclusive positioning to make certain that every one of those approached are accredited capitalists. Individuals or celebrations that desire to be certified financiers can come close to the provider of the unregistered safeties.

Expect there is a specific whose income was $150,000 for the last 3 years. They reported a primary house value of $1 million (with a home loan of $200,000), a car worth $100,000 (with a superior financing of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

Total assets is calculated as assets minus responsibilities. This person's total assets is specifically $1 million. This entails a calculation of their possessions (other than their key home) of $1,050,000 ($100,000 + $500,000 + $450,000) less a vehicle loan equating to $50,000. Given that they satisfy the total assets need, they qualify to be a certified capitalist.

Comprehensive Accredited Investor Platforms

There are a couple of less usual qualifications, such as managing a depend on with more than $5 million in assets. Under government safeties laws, only those who are approved capitalists might join certain securities offerings. These might include shares in personal placements, structured products, and private equity or bush funds, among others.

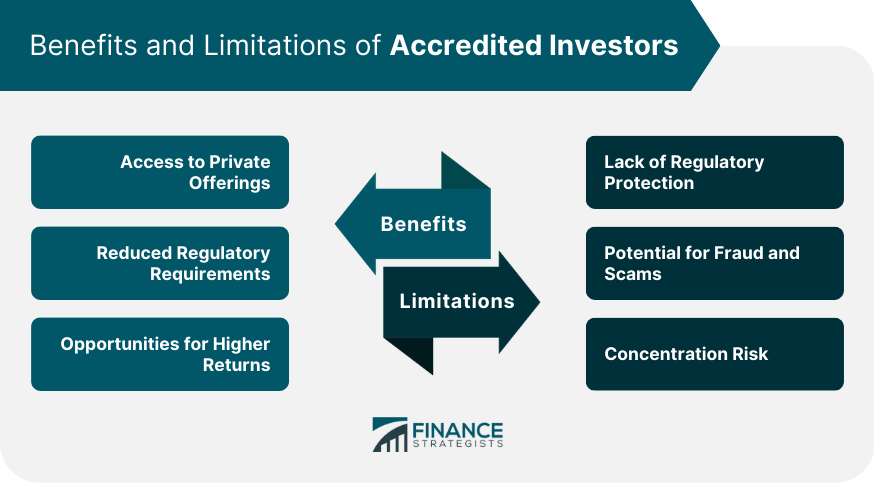

The regulatory authorities intend to be certain that participants in these highly risky and complicated financial investments can fend for themselves and evaluate the dangers in the lack of federal government protection. The accredited capitalist rules are made to secure prospective financiers with minimal economic expertise from risky ventures and losses they might be unwell geared up to hold up against.

Recognized financiers satisfy credentials and expert requirements to access exclusive investment possibilities. Designated by the United State Stocks and Exchange Compensation (SEC), they gain entrance to high-return alternatives such as hedge funds, equity capital, and exclusive equity. These financial investments bypass full SEC enrollment but lug greater dangers. Certified investors should meet revenue and total assets needs, unlike non-accredited individuals, and can spend without limitations.

Value Accredited Investor Property Investment Deals

Some vital modifications made in 2020 by the SEC consist of:. This modification recognizes that these entity types are often used for making investments.

These changes expand the accredited capitalist swimming pool by around 64 million Americans. This larger access supplies much more chances for capitalists, but additionally boosts prospective threats as much less financially sophisticated, financiers can take part.

These financial investment options are exclusive to certified capitalists and organizations that qualify as an approved, per SEC regulations. This gives recognized capitalists the chance to invest in emerging business at a phase before they think about going public.

High-Growth Exclusive Investment Platforms For Accredited Investors for Expanding Investment Opportunities

They are considered as investments and are available just, to qualified clients. In enhancement to well-known firms, qualified capitalists can select to purchase start-ups and promising endeavors. This provides them tax obligation returns and the opportunity to go into at an earlier phase and possibly gain benefits if the company thrives.

For investors open to the dangers entailed, backing start-ups can lead to gains (exclusive deals for accredited investors). Several of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage start-ups supported by approved angel investors. Advanced investors have the opportunity to check out investment alternatives that may generate more profits than what public markets use

Tailored Accredited Investor Funding Opportunities for Accredited Investors

Returns are not assured, diversification and profile improvement options are increased for capitalists. By expanding their portfolios via these increased financial investment avenues accredited financiers can enhance their strategies and potentially attain remarkable long-lasting returns with correct danger management. Experienced investors frequently encounter investment options that may not be easily readily available to the basic capitalist.

Investment choices and securities provided to accredited investors usually involve greater dangers. Exclusive equity, endeavor funding and bush funds commonly concentrate on investing in assets that bring danger yet can be sold off conveniently for the opportunity of greater returns on those risky financial investments. Researching prior to spending is critical these in scenarios.

Lock up durations avoid investors from taking out funds for more months and years at a time. There is likewise far much less openness and regulatory oversight of personal funds compared to public markets. Capitalists might have a hard time to properly value exclusive properties. When taking care of dangers recognized financiers require to analyze any personal investments and the fund managers involved.

Top-Rated Accredited Investor Real Estate Investment Networks for Accredited Investor Platforms

This modification might expand accredited investor standing to an array of people. Allowing partners in dedicated partnerships to combine their sources for common qualification as accredited capitalists.

Allowing people with particular specialist qualifications, such as Collection 7 or CFA, to qualify as accredited financiers. Producing extra demands such as evidence of financial proficiency or efficiently finishing an accredited financier test.

On the other hand, it can also cause skilled financiers presuming too much threats that might not appropriate for them. So, safeguards may be required. Existing certified capitalists might face boosted competitors for the ideal investment chances if the pool expands. Firms elevating funds might gain from a broadened certified investor base to draw from.

Best Accredited Investor Passive Income Programs

Those that are currently thought about recognized financiers need to stay updated on any kind of alterations to the requirements and policies. Businesses seeking recognized investors should remain attentive concerning these updates to ensure they are attracting the right target market of investors.

Table of Contents

- – Turnkey Accredited Investor Financial Growth O...

- – Comprehensive Accredited Investor Platforms

- – Value Accredited Investor Property Investment...

- – High-Growth Exclusive Investment Platforms Fo...

- – Tailored Accredited Investor Funding Opportu...

- – Top-Rated Accredited Investor Real Estate In...

- – Best Accredited Investor Passive Income Prog...

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing

More

Latest Posts

How To Invest In Tax Liens Online

Tax Lien Certificate Investing Risks

Tax Liens Investing